TL;DR

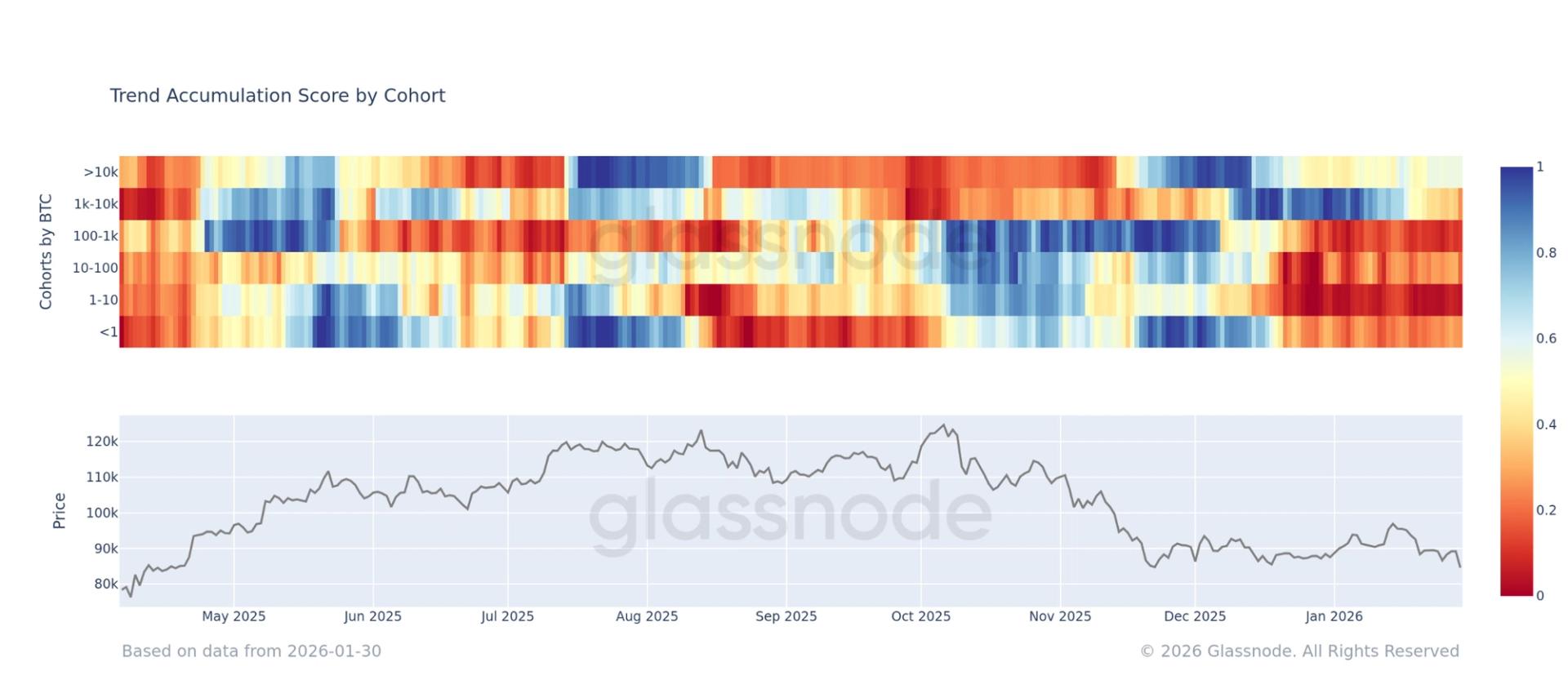

Glassnode data indicate large bitcoin holders are accumulating, while retail investors are continuing to distribute their holdings, signaling divergent behavior between institutions accumulating supply and retail selling.

The whole 9 yards of 💩

Retail traders are sprinting for the exits as bitcoin wobbles through another selloff, and yes, the drama has all the subtlety of a soap opera on fast-forward. Meanwhile, the so-called mega-whales are quietly loading the cannon for the next dip, which is exactly the kind of quiet, deliberate money move that makes market nerds like me perk up and then squint at the price charts like a detective with a magnifier. If you thought crypto was a simple “buy low, sell high” game, you’re either new here or you’ve been binge-watching the wrong conspiracy theories. The data, as ever, keeps things honest in its own nerdy way: Glassnode data shows large bitcoin holders accumulating, while retail remains in distribution.

What the numbers are actually saying is a lot more telling than the latest price swing. Glassnode’s on-chain signals point to accumulation among the big addresses—the sort of money that tends to move markets more by posture than by tweets. In the meantime, retail traders appear to be in distribution mode: selling into the bounce, or shrinking exposure as the chart paints another red candle. It’s not a cosmic mystery; it’s a classic case of macro-psychology meeting on-chain reality. The big holders aren’t panic-buying; they’re quietly expanding their slices of the pie while the little guy trims his. And yes, that divergence between the price action and the on-chain behavior is the kind of thing that makes seasoned observers lean forward, then lean back, and shrug while adjusting the tie.

So, what does this actually imply for the next few weeks or months? Skepticism, first. The market loves to tell a story where accumulation by the big players means “the bottom is in.” It’s seductive to believe that large holders nibbling away at the supply must mean a sustained updraft is inevitable. It isn’t. Accumulation can be a prelude to another liquidity-driven rerun, a rinse-and-repeat pattern where big money sits tight until a fresh macro catalyst—or a fresh round of enthusiastic media coverage—loosens the chokehold on price. On the other hand, excitement isn’t just noise either. If this accumulation persists, you’re looking at a potentially healthier base for the next leg up than a retail-driven squeeze would provide. The real takeaway is nuance: on-chain signals are informative, not prophecy, and the smartest players treat them as one piece of a much larger puzzle.

This is where the practical commentary lands for real-world readers or traders who actually want to make informed decisions. If you’re a long-term holder who believes in the network’s long-term value proposition, this is a data point that suggests the market isn’t collapsing into oblivion—though it might not be a straight line to moonville either. For the shorter-term trader, the scene is a reminder that dips can be bought, but not all dips are created equal. The presence of accumulation by large holders can translate into upside if and only if macro conditions cooperate and liquidity holds. If you’re waiting for a single signal to unlock the door, you’re likely to be waiting a while. Diversification, patient capital, and a disciplined approach to risk remain your best allies in a world where the chart can sing one tune and the on-chain data hums another.

And yes, I’m cautiously optimistic. The juxtaposition of retail selling and mega-holdings quietly stacking is not a recipe for instant euphoria, but it is a narrative that deserves attention. It hints at a market where the supply/demand dynamics aren’t simply “sellers vs. buyers” in a two-player game; they’re a chorus: a chorus of retail exit doors, institutional patience, and long-term holders who won’t rush to cash out their bets at the first sign of a dip. If this pattern persists, it could signal a healthier, more sustainable cycle rather than a frantic, stomach-churning cliff dive. The crypto market has earned its reputation for dramatic pivots; this time, the lines are a little subtler, and that’s worth watching.

So, where does that leave you, reader? Stay skeptical, stay curious, and don’t let the headlines hijack your thesis. There’s real signal in Glassnode’s numbers, but there’s plenty of noise in the price. Use the on-chain reality as a guide, not a mandate—and if you’re tempted to chase the dip with reckless abandon, at least have a plan, a risk ceiling, and a respect for the fact that markets love to surprise you just when you feel most confident. The dip-buying narrative is alive, but not guaranteed. The truth is somewhere in between a cautious shrug and a quiet celebration—perfectly embodied by the minutes you spend thinking, not reacting. Signed, The Royal Flush.

- source